Company Tax Rate 2019 Malaysia Calculator

It includes explanatory notes to guide taxpayers through their tax computations and validation checks against common errors.

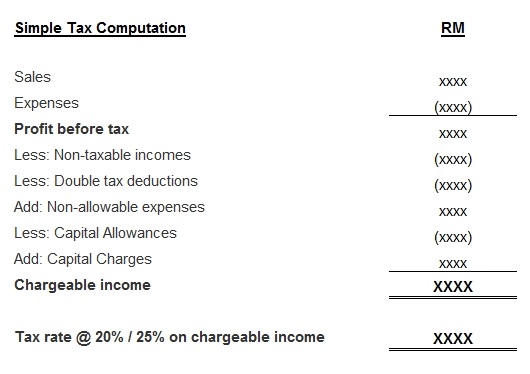

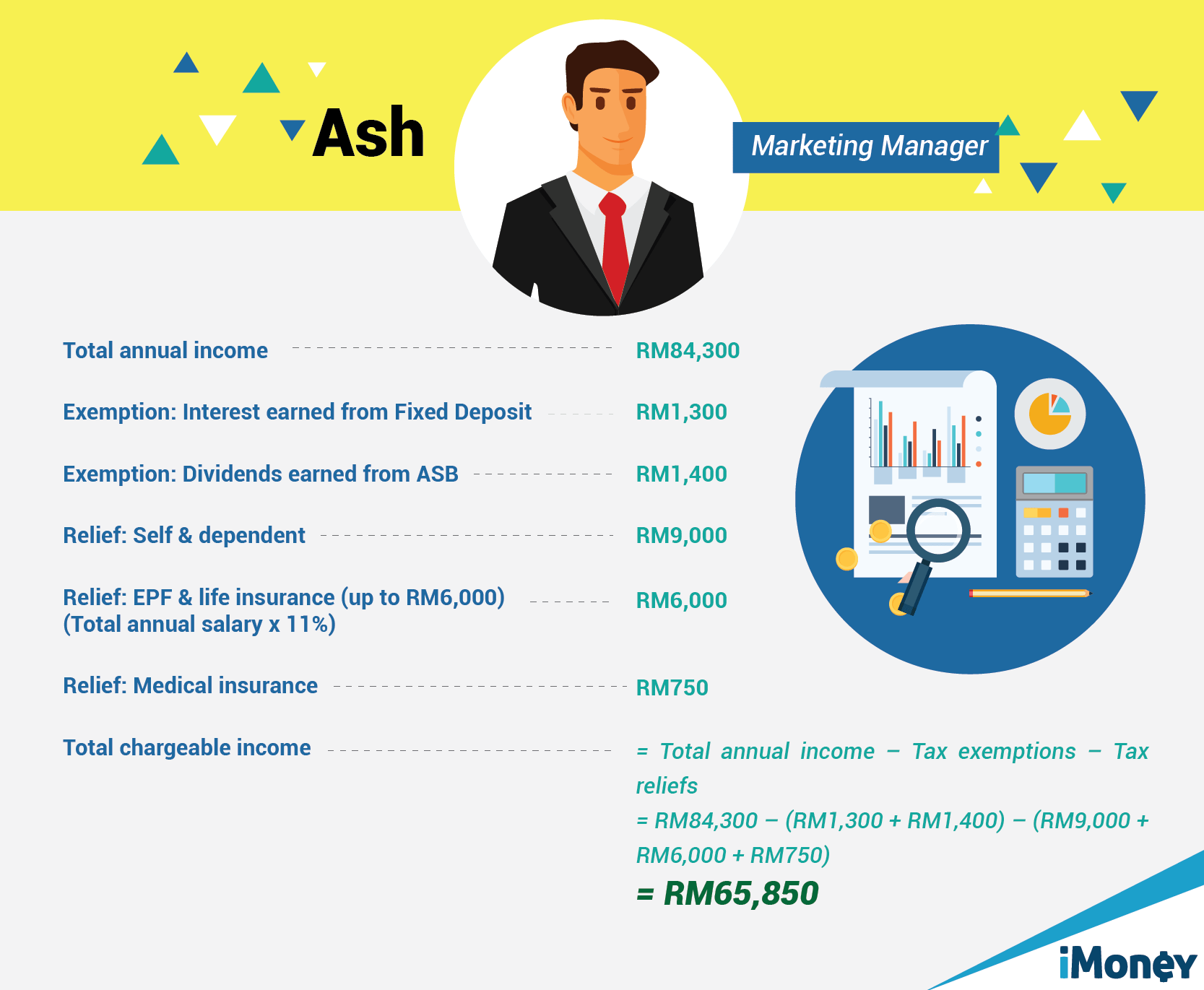

Company tax rate 2019 malaysia calculator. From the 2017 18 income year to work out the company tax rate for franking your distributions otherwise referred to as corporate tax rate for imputation purposes you need to assume your aggregated turnover assessable income and base rate entity passive income will be the same as the previous income year. Resident company with paid up capital of rm2 5 million and below at the beginning of the basis period sme note 1 on first rm500 000 chargeable income 17. Chargeable income myr cit rate for year of assessment 2019 2020. Malaysia income tax e filing guide.

How does monthly tax deduction mtd pcb work in malaysia. Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. How to pay income.

On subsequent chargeable income 24. What is tax rebate. With paid up capital of 2 5 million malaysian ringgit myr or less and gross income from business of not more than myr 50 million. What is income tax return.

Tax relief for year of assessment 2019 tax filed in 2020 chapter 5.